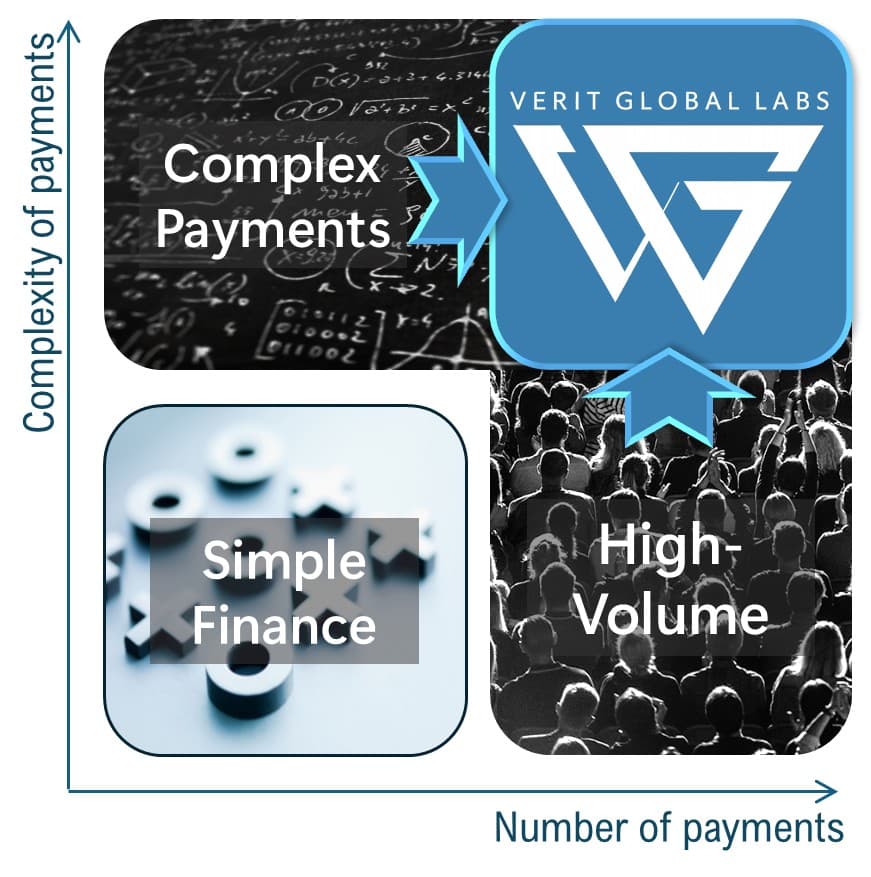

Numbers that don’t add up.

Penny drift, CSV roulette, and systems that disagree create audit holds and delayed closes.

- Pennies leak at scale: floating-point + rounding drift.

- Two truths problem: ERP vs PSP totals don’t match.

- Reconciliation firefights slow finance and stall payouts.